Benedict Evans recently did a great 2018 market share analysis for Amazon on its share of US e-commerce and addressable US retail. This post will replicate the same analysis but for 2019 figures.

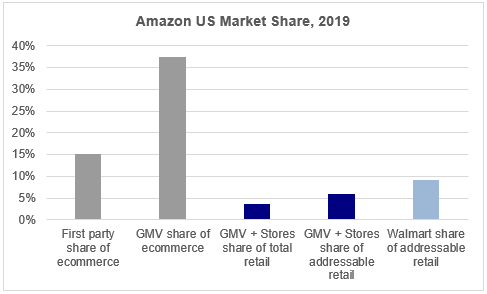

In summary, Amazon has about 37% of US e-commerce. Against addressable retail (i.e., excluding cars, car parts, gasoline stations, and restaurants and bars), Amazon has approximately a 7% share.

Market share is defined as Amazon’s relevant business segment divided by the total market (i.e., e-commerce or addressable retail).

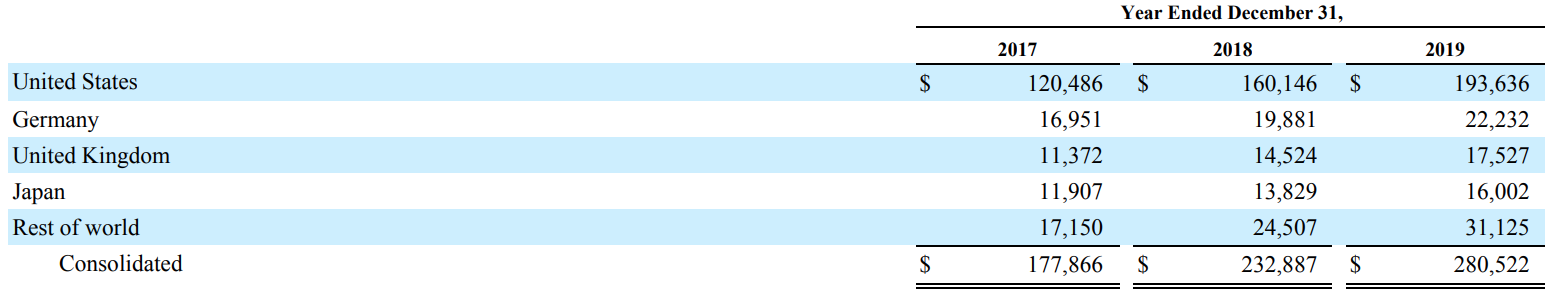

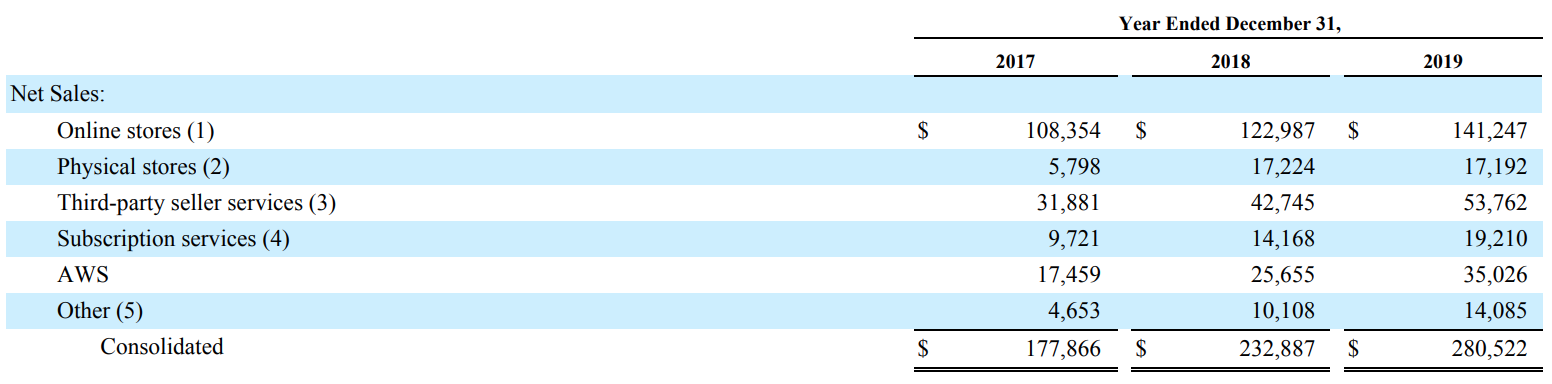

Amazon discloses a breakdown of revenue by geography and business segment (in millions). US revenue in 2019 was $194bn, growing 21% YoY. The direct e-commerce business (“Online stores”) made up 50% of Amazon’s revenues.

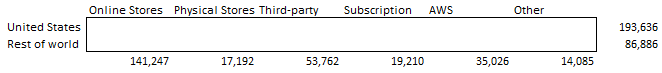

To get an estimate of Amazon’s US e-commerce revenue, we’ll have to to fill in some of this table, as Evans did:

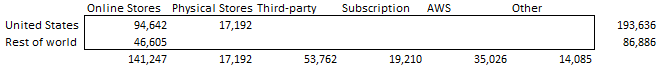

Given that Whole Foods makes up most of the “Physical stores” segment and is mostly in the US, if we exclude the stores, ~67% of Amazon’s revenue is in the US. If we assume the same proportion in the company’s e-commerce segment, the table will look as follows:

These assumptions give us $94.6bn of US e-commerce revenue from its first-party segment. Now, we’ll need to add the US third-party Gross Merchandise Value (GMV) figures to get Amazon’s total e-commerce sales.

Amazon first disclosed GMV numbers in its 2018 shareholder letter with global first-party sales at $117bn and third-party sales at $160bn. However, the 2019 shareholder letter did not disclose these figures. To get Amazon’s GMV, we’ll use Marketplace Pulse’s estimates of $135bn of global first-party sales (note that this is different from the $141bn reported in the 10-K) and $200bn of third-party sales. This estimate makes sense if we took the same third-party take rate in 2018 ($43bn/$160bn = 27%) and same proportion of GMV to Online stores revenue in 2018 ($117bn/$123bn = 95%) and apply that to the 2019 figures.

Assuming that 67% of Amazon GMV is from the US, and using the $135bn first-party number instead of $141bn, that translates to in the US in 2019:

- Amazon sold $90.5bn of products for its first-party business

- Sold $134.0bn for third-parties

- In total, US GMV is roughly $225bn

The US Census Bureau reports an estimated US e-commerce 2019 sales to be $599.5bn, so:

- Amazon’s first-party business had about 15% market share of e-commerce

- Third-party had about 22%

- Total GMV had a 37% share

If we look in terms of overall US retail, we’ll have to add back the US physical stores, totaling about $242bn.

Total US retail was $6.2tr in 2019. To get to addressable retail, we’ll exclude cars, car parts, gasoline stations, and restaurants and bars, which totals $3.7tr in 2019.

Hence, Amazon’s US retail GMV and physical stores revenue of $242bn was about 6.5% of US addressable retail. Compared to Walmart, which had $341bn of sales in the US in 2019, Amazon had ~71% of the share of addressable US retail as Walmart does.

Compared to 2018, Amazon continues to capture share in 2019 for US e-commerce (37% vs 35%) and addressable retail (7% vs 6%).

With increasing antitrust scrutiny from the US government, Amazon’s position in e-commerce is certainly dominant. Yet, framing in terms of total addressable retail, its 7% share does not scream monopoly.